Cryptocurrencies have already found and established their place in the market. There is increasingly ongoing research on them, which gives this technology a very promising future. Currently there are two main choices for earning cryptocurrency: ASIC mining and GPU mining. In this article we summarise the reasons and advantages behind each method and compare their usage. Let us make some general comments before we review each method.

Technology evolves very fast, especially in new markets like the cryptocurrency one. This market is also highly volatile, and so flexibility is an important factor which needs to be taken into account when investing in it. Another important factor is energy consumption. All in all, when thinking about the costs of mining cryptocurrency the initial investment is as important as the ongoing costs that it will involve daily.

With both ASIC and GPU mining, if we want to make a big profit the initial investment has to be high. The maintenance cost is also non-negligible. In the following table we summarise the main pros and cons for both mining methods.

| ASIC mining | GPU mining |

|---|---|

| Specific to one algorithm | Can be used to mine any coin |

| No market flexibility | Easily adaptable to the market changes |

| Centralises the market | Promotes decentralisation |

| Lower energy consumption | Higher energy consumption |

| High mining efficiency: potentially very high profits | Lower mining efficiency |

| Plug and mine | Requires some more setup |

Now, as shown in the table, all cryptocurrencies are based on the idea of decentralisation. Instead of having central, world-wide organisations which have the control of all the financial infrastructure, cryptocurrencies are based on the opposite idea: ideally, to have every computer in the world monitoring and validating all economic transactions.

That is why it is increasingly popular for new cryptocurrencies to be ASIC-resistant, like Ethereum or Bitcoin Gold. Another important point that can no longer be avoided is the amount of energy that current cryptocurrencies need in order to function. Part of the aforementioned research is on developing alternatives to the Proof of Work (PoW) protocol, so as to decrease the computational waste that it involves.

An example of a proposed alternative which may be implemented soon in Ethereum’s network is the Proof of Stake (PoS) protocol, which will greatly decrease the amount of work required to validate blocks. That does not mean that all current (GPU) mining will vanish — it might be used in a more efficient, profitable way.

If you are not familiar with the last two paragraphs feel free to have a look at our introduction to blockchain and mining post, where we review the basics of how the blockchain technology works.

All these factors are relevant when thinking about mining cryptocurrency. The bigger picture cannot be neglected, as this is a very fast market which may completely shift in a matter of months. With this in mind, let us start reviewing ASIC mining.

Application-Specific Integrated Circuit (ASIC) mining

- Microchips designed to mine only a particular coin; they are algorithm-specific

- Very efficient miners, but also very expensive

- Energy consumption is lower

- Easy to set up and start mining

- Mining difficulty increases very rapidly — ASIC profitability drops fast

- Limited shelf life if coin forks

Let us first say in plain terms what an ASIC is. Let us start with the IC. An Integrated Circuit is what we commonly call a microchip. It is one of the greatest technological advances of the last century, and essentially any electronic equipment uses at least one nowadays. For example, most likely the CPU of your computer or phone which you are using to read this is one!

The AS stands for Application-Specific, and it means that this particular microchip has been designed for only one purpose. In the case at hand, to run a particular algorithm in order to mine a particular cryptocurrency. So, the term ASIC is generically used to describe a computer which has been designed to only serve one purpose: mine a particular coin.

Of course, since the ASIC has been designed specifically for a coin, it is the most efficient computer with the available technology to mine that coin. They have a higher efficiency than any other computer, and so if there is an ASIC available to mine a coin, the miners that possess it have a great advantage and dominate the market.

However, ASICs can be very risky even in the short term, for two main reasons. First, as the cryptocurrency market varies very fast (a coin may typically changes its value by 10% every day), the risk of mining only one coin is very high. If the value of that coin permanently drops or the developers decide to change the hash algorithm, the ASIC becomes useless.

Second, since technology advances very fast, and most importantly since the difficulty to mine a coin greatly depends on the computing power of the network, once an ASIC for a particular coin is released the difficulty for that coin greatly increases. Hence the profitability of the ASIC drops, even though it is the only viable way to mine that coin. And in just a few months most ASICs are not profitable anymore, as we can see in the following chart for SHA-256 (Bitcoin’s hash algorithm) ASICs:

Data from: https://www.asicminervalue.com/

Let us stress once again an important point: ASICs completely dominate mining in the coins where they can be used. Every time a new ASIC is released it has a very high profitability, since the energy consumption is also optimised. Even if their profitability drops fast, they are still the only viable way to mine that coin, until new more powerful ASICs are developed for that same algorithm.

This is an issue for the idea of ASICs in the long term. As we said, cryptocurrencies are built to promote decentralisation, but miners using ASICs completely dominate the market. In other words, the mining is centralised on ASIC owners. Therefore, the idea that anyone with their own computer has a chance to mine coins no longer makes sense.

A big part of the cryptocurrency community is concerned about losing decentralisation, and is actively researching for alternatives. Currently one of the most successful ones is to avoid the supremacy of ASICs by, for instance, developing new hashing algorithms which make them only as good as a (specialised) computer we could buy and build in any hardware shop.

To do so, platforms like Ethereum use ASIC-resistant algorithms, which require a lot of memory usage (what is known as memory hard hash functions). This does not stop the manufacturing companies to try and develop ASICs for these new algorithms, but the point now is that their hash rate is comparable to the one that can be obtained by stacking a few GPUs.

This leads us to GPU mining.

Graphics Processing Unit (GPU) mining

- Can be used to mine any coin

- Most GPUs are already almost optimal, but expensive

- Setup may require special cases for cooling, special motherboards, etc.

- Gives a chance (even if small) to all users — the distance between a specialised GPU mining rig and a typical computer is way smaller than that between a normal computer and an ASIC mining centre

- ASIC-resistant coins are becoming more and more popular

- Income with GPU mining is more stable

- Can also be used for other non-mining tasks and have higher resale value

As we just said, recently part of the cryptocurrency community has shifted towards ASIC-resistant coins, which for instance use memory hard hash functions, like Ethereum. Other coins followed a different strategy to be ASIC-resistant, like Ravencoin, which uses the X16R algorithm. This algorithm consists of concatenating eight different hashing algorithms, which are picked with repetition from a list of sixteen depending on the last bits of the previous block hash.

Using these algorithms ensures that ASICs will not dominate the market, as they will be either not viable to construct or will not give as big an advantage as with other coins. Other coins, like Monero, in order to avoid ASIC dominance change their PoW algorithm every few months. This can be seen very clearly in Monero’s hashrate chart. Every time the PoW algorithm changes, the hashrate drops dramatically as ASICs can no longer be used. Hence, anyone with a powerful GPU setup has a decent chance of mining some of these coins, recovering decentralisation.

The downside is that the most powerful GPUs in the market are not cheap, and typical GPU mining rigs may need to have many of them. Also, when stacking that many GPUs refrigeration also needs to be taken into account, as well as having enough RAM memory (depending on the hash algorithm) and a suitable motherboard. Energy consumption is also high.

A big plus of GPU mining when comparing it to ASIC mining is flexibility. GPUs, as their name indicates, are mainly built for image processing. That is, they are not designed for any particular cryptocurrency, and so they can be used to mine any coin. Certainly, if we consider a coin which can be mined with ASICs, like Bitcoin, GPUs do not stand a chance, as ASICs will easily dominate them. But as we said there is an increasing number of coins which are ASIC-resistant.

This flexibility is essential in the current cryptocurrency market, as if one coins stops being profitable, the same GPUs and setup can be used to mine another one. Also, GPUs are used in most computers for graphics and image processing, and so if cryptocurrency mining stops being profitable altogether, they can be used for other tasks or sold at a good price.

So what are the drawbacks of GPU mining, when compared to ASIC mining? First of all, energy consumption. As we said, ASICs are optimised for one particular coin, and so they maximise the efficiency, including energy consumption. Second, and most importantly, for coins using an algorithm which is not ASIC-resistant, ASICs completely dominate the mining, and making a profit with GPUs is implausible.

What is our current opinion on the subject?

.

Since we believe in the future of cryptocurrency, we are convinced that GPU mining is the way forward. ASICs dominate some of the current coins, but they are likely to become obsolete as a concept in the next few years. They are also very risky, as the investment needed to make a profit is very high, but the security to recover it with that hardware is low.

What’s more, AI and distributed computing may be the future direction of blockchain technology, and this direction might not involve ASICs in any way. GPU mining and blockchain seem to be evolving towards that direction. Stay tuned for new updates on this.

Why use Cudo’s software?

.

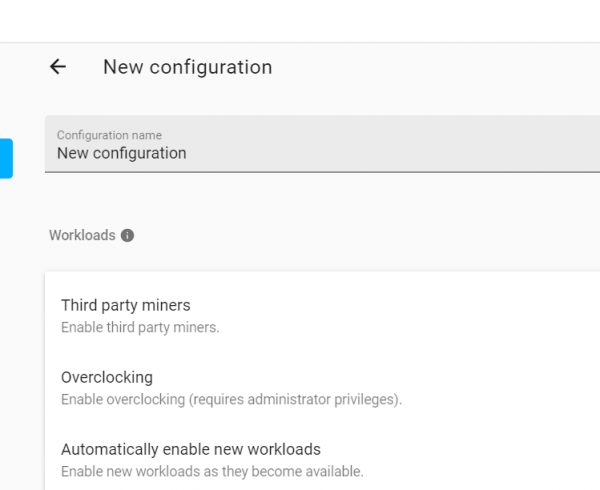

Cudo offers a very easy way to mine cryptocurrencies using your GPUs. We have algorithms which decide which is the most profitable coin to mine at every moment, and we get your hardware to work in that one. We then pay you in the coin of your choice at the current market exchange value. Therefore, in addition to doing all the work for you in terms of setup and mining, we also maximise the profit that you can make with your GPUs.

Leave a Comment